About Us

- Who We Are

- Why Fusion?

- What Others Say

- Our Blog

- Regulations and Legal Documents

- ID Documentation

Fusion Markets

Legal

Trading

- Products and Accounts Overview

- Zero Account

- Classic Account

- Demo Account

- Fusion Pro

- Swap Free Accounts

- Forex

- Metals

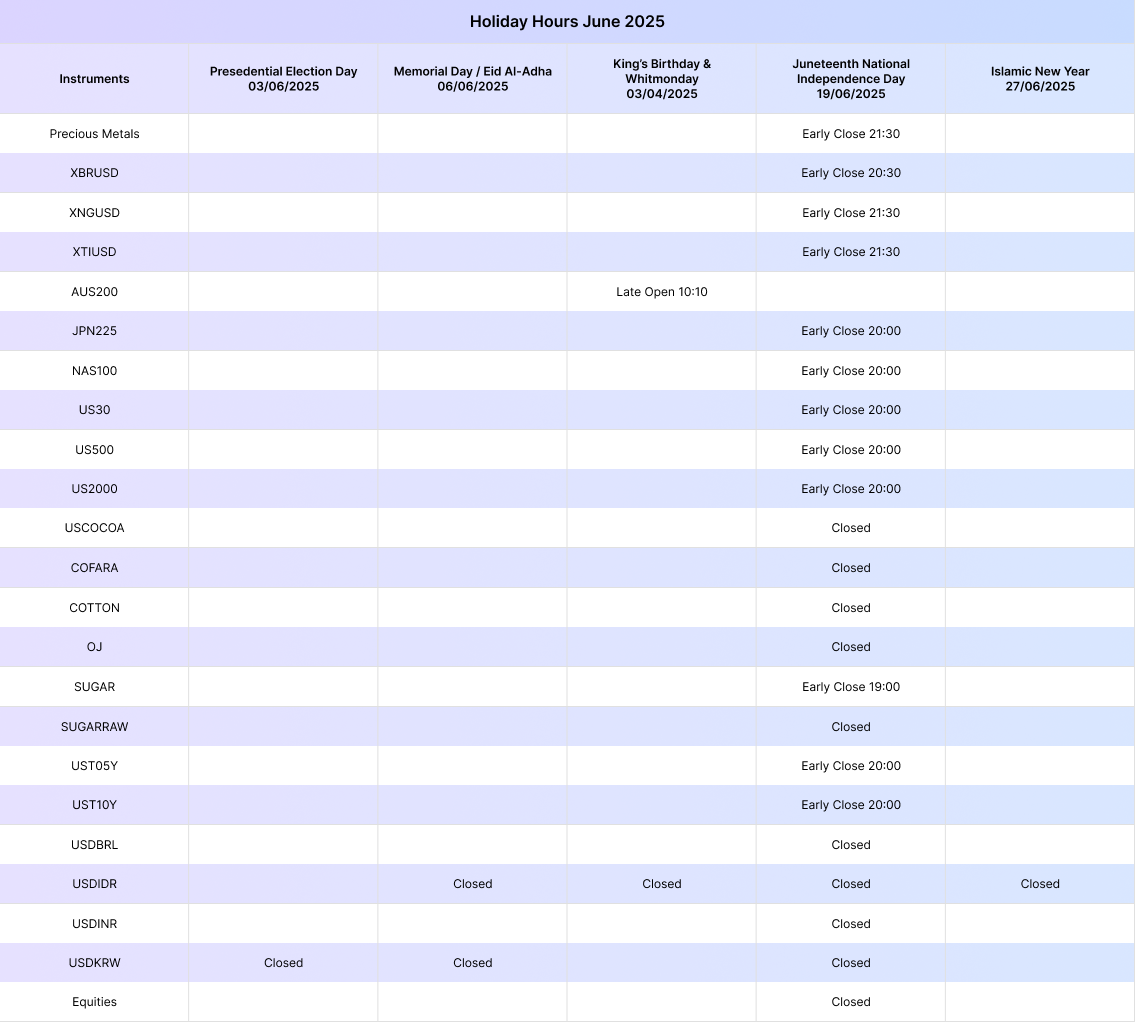

- Indices

- Energy & Soft Commodities

- Cryptocurrency

- US Shares

- Trading Conditions

- Deposit Options

- Withdrawal Options

- Trading Calculators

- Economic Calendar

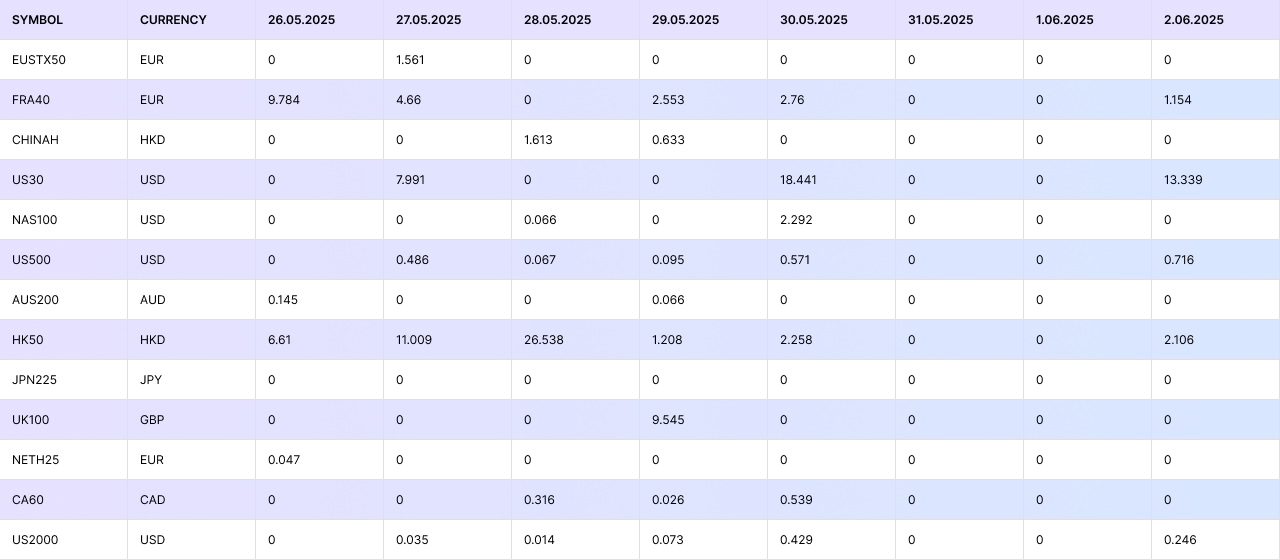

- Live and Historical Spreads

- Trading Tools

- Fusion+ Copy Trading

- Sponsored VPS

Products and Accounts

CFD Markets

Resources

Platform & Tools

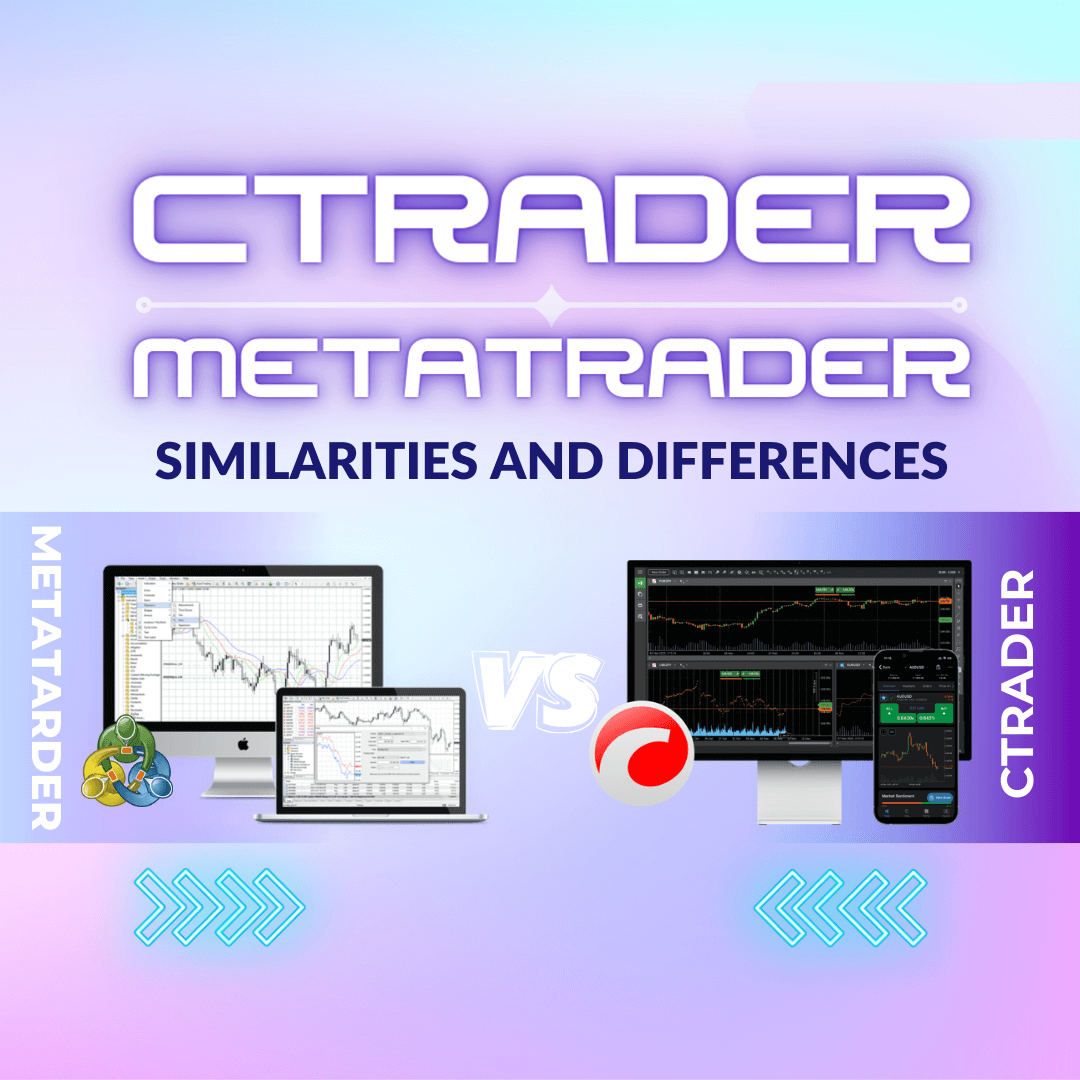

- MetaTrader 4

- MT4 Mobile Apps

- WebTrader for MT4

- MetaTrader 5

- TradingView Desktop

- TradingView Mobile

- cTrader Desktop

- cTrader Mobile

- cTrader Web

- DupliTrade

MetaTrader 4/5

TradingView

cTrader

More Platforms

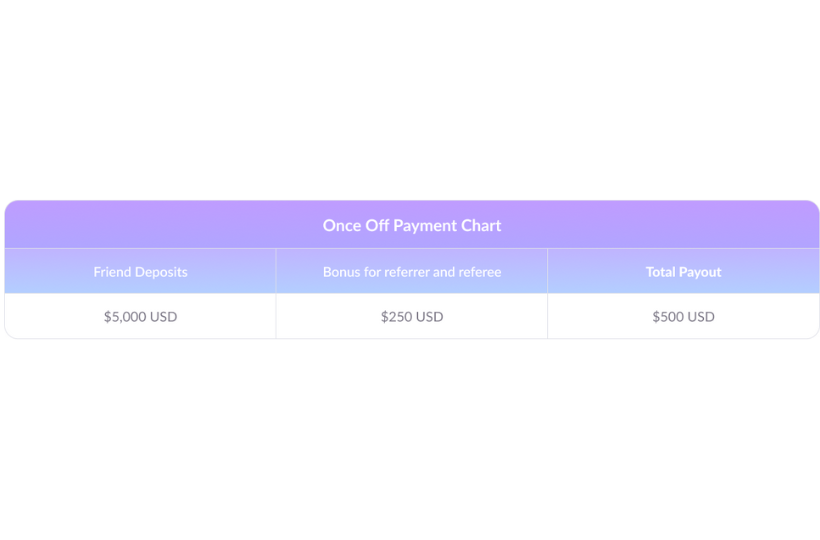

Partner with us

Help

- Contact Us

- FAQ

Help